Plus, receive recommendations and exclusive offers on all of your favorite books and authors from Simon & Schuster.

Table of Contents

About The Book

DO YOU KNOW WHAT YOU NEED TO KNOW ABOUT YOUR MONEY?

* If your husband died, could you keep living in your current home?

* Do you know how much money you have for retirement?

* Are you afraid of becoming a "bag lady"?

Many smart, competent women feel insecure about dealing with money. They delegate authority to their spouses or an adviser, or they pretend financial issues simply don't exist -- and at the same time they fear they will suddenly be left without money. But ignoring your financial safety can lead to disaster. Here, in plain English, are all the answers you need to feel secure about your future.

The Money Club contains the lessons of a group of successful women who, despite their personal and professional achievements, didn't know enough about their finances. They joined together to learn what they needed to know, and now they share their knowledge with you. Here are all the answers you need for saving, investing, and planning for your future -- plus advice for every major financial transition in your life, from getting married to coping with widowhood -- presented in clear, easy-to-understand writing.

Don't let your "bag lady fears" overwhelm you -- take control of your finances today with The Money Club!

* If your husband died, could you keep living in your current home?

* Do you know how much money you have for retirement?

* Are you afraid of becoming a "bag lady"?

Many smart, competent women feel insecure about dealing with money. They delegate authority to their spouses or an adviser, or they pretend financial issues simply don't exist -- and at the same time they fear they will suddenly be left without money. But ignoring your financial safety can lead to disaster. Here, in plain English, are all the answers you need to feel secure about your future.

The Money Club contains the lessons of a group of successful women who, despite their personal and professional achievements, didn't know enough about their finances. They joined together to learn what they needed to know, and now they share their knowledge with you. Here are all the answers you need for saving, investing, and planning for your future -- plus advice for every major financial transition in your life, from getting married to coping with widowhood -- presented in clear, easy-to-understand writing.

Don't let your "bag lady fears" overwhelm you -- take control of your finances today with The Money Club!

Excerpt

CHAPTER I

GETTING IT TOGETHER

Founding The Club

My husband confessed that he was having huge financial problems and hadn't been paying the mortgage. We were in danger of losing our home. We needed new advisors to replace the lawyer and accountant who'd let us slide into a financial chasm, and I wasn't sure how to use my own money to protect the two of us. Thank God I'd joined the club. I had networks to reach out to, people to consult. Best of all, when we got advice, I understood the issues. I had a confidence I'd never had before, and to my lasting pride, I'm the one who got us out of trouble. Every woman should have a club like this one. -- Anonymous

From 1985 to 1995, the all-female investment clubs in America -- about 41 percent of the total number of clubs -- outperformed the all-male clubs (13 percent) by three to one. Today's women aren't meeting to make quilts. They're weaving financial safety nets.

There are many investment clubs in America, but ours is unique. Thought at the beginning we spent most of our time on investments,that was simply to lay the foundation. We intended to branch out and educate ourselves about money and everything else that affected our financial lives. And that's just what we have done.

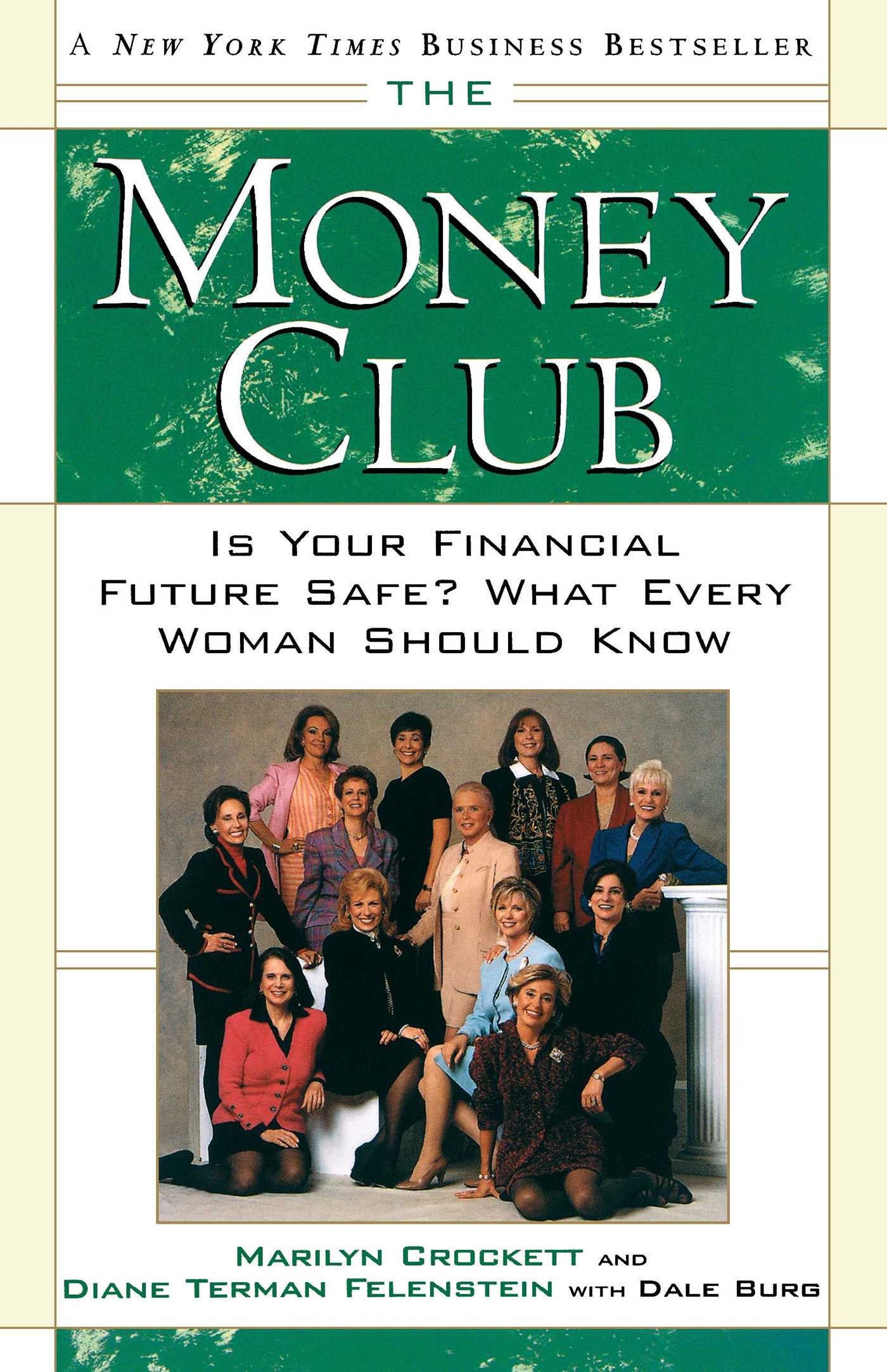

When the women who would become The Money Club gathered in a Manhattan apartment for the very first time, there were eighteen people in the room -- married and single, widowed and divorced. Most were linked only through their friendship with Diane. On the jacket of the book are some of the charter members and others who became important to our success. They are:

Top row, left to right:

Vivian Serota, a glamorous, earthy, effervescent patron of the arts, has a diverse management and theatrical production background. She serves on the board of Daytop Village International addiction treatment centers and the Guggenheim's "Learning to Read Through the Arts." She is married and the mother of a married son and married daughter.

Carol Levin, a women's activist, brings the pixie charm of Liza Minnelli, an offhand humor, and tremendous vitality to her beloved Women's O.W.N. (Optimum Wellness Now) and many other projects. She and her husband, the CEO of Revlon, have one daughter in high school and a married son and daughter-in-law who have followed them from Minneapolis to New York.

Carol Safir, like her husband, Howard, the New York City Police Commissioner, former Fire Commissioner, and onetime Associate Director of the U.S. Marshal Service, has worn many hats, among them real estate agent and international business consultant. An auburn-haired "girl next door," she has a son fresh out of law school and a daughter who is a newly minted FBI agent.

Carlyn McCaffrey has a wry wit and sharp mind that have earned her an exalted reputation among trusts and estates attorneys while her genuine concern has earned her the gratitude of her clients. A partner in the New York law firm of Weil, Gotshal & Manges, she has a bicontinental relationship with her husband, who presently works in Europe. They have four adult children.

Second row, left to right:

Diane Steiner, with a dazzling smile and great determination, blends empathy and intelligence with a passionate commitment to her clients' rights that make her a top matrimonial lawyer in one of New York's premier firms, Sheresky, Aronson & Mayefsky. She is married and the mother of a grown son and daughter.

Kate Coburn, lively and curly-haired, packs a lot of energy and drive into a size-four body. Well known in New York real estate circles as the head of retail leasing for Rockefeller Center, she now advises other owners, developers, and retailers on strategic marketing and leasing issues.

Diane Terman Felenstein.

Gloria Gottlieb, a willowy blonde with a mischievous grin, started an insurance business with her husband just after their marriage. They are now among New York's top agents. Their park-view home is filled with modern art and photos of their grown son and daughter.

Bottom row, left to right:

Margot Green, dark-haired, trim, and elegant, turned her sophisticated taste into a business asset and founded a custom couture establishment. Known to her clientele as "the fastidious fitter," she is the mother of two adult sons.

Harriette Rose Katz, a statuesque blonde and leading New York event planner of private and public celebrations, is also a culinary expert and oenophile who has been awarded the title Conseiller Gastronomique des Etats-Unis and heads the New York chapter of La Chaîine des Rôtisseurs. She recently planned the wedding of her daughter.

Marilyn Crockett.

Jane Bishop Shalam, a delicate beauty, marshals her abundant charm and formidable organizing skills to get extraordinary results as a community activist and as a dedicated club member. Married and the mother of three sons, she's also helping raise her widowed brother's preteen daughter.

Carol S. Kogan combines the cool elegance of a fashion model with the mind of a crackerjack executive. Formerly president of several top women's designer apparel companies including Bill Blass and Oscar de la Renta Studio for Hero and Christian Dior Sportswear for the Jones Apparel Group, she has a business network throughout the United States, Europe, and the Far East. She divides her energies among her own consulting company, her husband's international movie business, her son, daughter, and new granddaughter.

Other founding members of the club, not pictured, include:

Donna Bijur and Linda Lieberman, directors of Service Party Rental. Donna is now a consultant in Sweden, and Linda has also launched another business, "Just Linens."

Bambi Felberbaum, a board member of several hospitals, is a supporter of philanthropic programs that focus on women's, children's, and medical issues. She is married with two adult children.

Karen Fisher is the president of Designer Previews, a designer referral service.

Joann Jordan, a real estate broker for fifteen years, is currently with Ashforth Warburg Associates. Joann, who became the second president of the club, is a widow with an adult son and daughter.

Pat Weinbach, a designer, heads her own firm specializing in remodeling and renovations. She is married, with three adult children.

We had a lot of experience under our collective belt. Among us, we had traveled the world, met with statesmen and popes, been invited to the White House and the Academy Awards, run volunteer organizations with million-dollar budgets, and demonstrated our competence in executive offices and professional suites.

But those of us who were married didn't discuss money issues with our husbands, to whom we'd left all the financial control. If single, we stumbled along as best we could. Very little stumped us in other areas, but we knew nothing about dealing with our money. We didn't know how to calculate what we had, what to do about it, how to protect it, even how to find and talk to people who could help us. The very subject of personal finance frightened us.

Our group included women with power and access in their own right and/or married to highly placed professionals, some of whom were top executives at leading investment banking and accounting firms. Being generally well connected, we had access to information that others might not. But having money and access isn't the same as feeling in control of the money or knowing how to use the access. As a group, we were as financially unsophisticated as could be.

Even the wives of top-echelon money men didn't know any more about finance than anyone else. Money, investing, personal finance -- these subjects are on the dark side of the moon for many women, including all of us. And though on the surface every woman in our group was traveling in privileged circles, we eventually realized that almost all had faced a personal crisis around an issue of money. Our families had struggled, we'd seen fathers and husbands fail, we'd been obliged to support ourselves on our own and been left in a financial lurch when widowed or divorced.

One of our members was just in her twenties when her husband died of heart failure, leaving her with a baby; remarrying a few years later, she was widowed a second time. After her divorce, another member went to withdraw savings from the bank and discovered her husband had drained the account. As a young wife, another had helped her husband write checks for bills each week and later found that he'd put the carefully stamped envelopes into the incinerator instead of the mail slot. Another came home one Sunday to discover her husband gone and the house picked clean. Every piece of furniture and shred of clothing had been stored or sold. She never saw any of it again.

Even after joining our club, some members had to come to grips with devastating changes. Two lost high-powered jobs and all the financial benefits that come with them. When we considered doubling the amount of our monthly contributions, they told us that if the obligation went up, they'd have to drop out, so we kept the status quo. When someone's husband had a business failure that forced him into bankruptcy, we joined forces to help her out during that difficult period. Our second president, Joann Jordan, lost her husband suddenly and without warning. Becoming immersed in club activities was one means of coping. "It was a diversion from my grief and a form of self-protection, because it helped me learn how to maximize my finances." Being in the club has made a big difference to every single one of us, each in her own way.

We are a no-frills operation. There is no coffee served and little socializing. We get right to business and rush off to our offices and duties immediately afterward. Still, because we are dealing with a subject that affected the underpinnings of our lives, we have bonded more closely than any group we'd ever been part of.

At the beginning, we used the words "frightened" and "stupid" to describe how we felt, and we discovered we had plenty of company. We learned not to allow anyone to "pull the ignorant strings," as one woman described it. Everyone was encouraged, given the freedom to ask questions and make mistakes, to receive sympathy and face challenges. That nurturing environment was a huge help.

Learning together makes you feel safe -- like Weight Watchers or Overeaters Anonymous. -- Carol Levin

In learning how to care for ourselves, we became competent to help each other. In times of need, we can now help choose attorneys and accountants and insurance brokers. We have suggestions of substance. We have grown in competence and confidence and developed the tools and resources to empower ourselves.

From our positive experience came the desire to let other women know that though we might live in the middle of New York City, we are in many ways like women all across America. We have experienced the same fears and feelings of powerlessness, and we know that they can learn to take control just as we did. Starting your own club may be the first step in the process.

Fortunately, our club had just the right people to help us find our way. Diane is the leader-cheerleader who motivates the members with her enthusiasm and keeps our bonds strong. If necessary she soothes ruffled feathers and sifts through complaints to see which have merit and must be addressed. She has an unflagging belief in the importance of the club, and her absolute faith has held it together.

Marilyn has kept the members on educational course, guiding us through the fundamentals of personal finance and eventually acting as a sounding board. She helps interpret the reports on potential investments and connects them to what's happening in the market. She has found a wide range of guest speakers.

The National Association of Investors Corporation (NAIC) is immensely helpful in setting up a club, though we augmented their suggestions with a do-it-yourself approach. Fortunately, we had wonderful assistance from our attorney, Charles J. Hecht; our accountants, Carolyn Specht, CPA, of Pierpoint Associates and Anthony Graci of Grodsky, Caporrino, & Kaufman; and our banker, Philip Glazer at Republic National Bank.

We concluded that the best structure for our particular club would be an LLC -- a limited liability company, which combines the tax benefits of a partnership with the limited risk of a corporation. The latter was especially important to those of our members who had significant assets in their own names.

Charles drew up the papers and helped us adopt an initial set of bylaws to govern the day-to-day working of the club. A bigger challenge was in selecting officers. None of us had any experience with an organization of this kind, yet we knew that the first group of leaders would be establishing precedents. Certainly successive officers would modify them, but the first officers would be blazing the trail.

HOW THE MEMBERS RUN THE CLUB

Diane was elected our first president, largely on the theory that she was the driving force behind the club and couldn't quit even if she wanted to!

Kate Coburn was elected vice president, because of her extensive business experience.

Carol S. Kogan served as our first treasurer, primarily because she had had a great deal of bottom-line responsibility in her career. In addition to keeping the club's books, Carol checked over the brokerage house statements and other financial accounts and worked with the accountant. Though the job was extremely time-consuming, she probably learned more than anyone else in the club.

Donna Bijur and Linda Lieberman, who already worked together running one of the city's largest party rental firms, agreed to keep working together as co-secretaries. Taking the lengthy minutes that documented all our decisions proved to be a major job.

These officers and Marilyn constituted our first Executive Committee, charged with developing proposals and policies that could be considered by the membership.

The first set of officers worked much harder than they had expected to. At the end of a year, they handed the torch over to their successors: Joann Jordan became president, Jane Shalam became vice president, and Margot Green became treasurer. Joann personally called many members to ask their guidance in strengthening and improving the club. The members were unanimous in their praise of the guest speakers. They wanted even more of them, covering even more subjects; they wanted to proceed faster and learn about more sophisticated concepts, like convertible bonds and selling short. But Joann and Marilyn agreed not to rush ahead, to proceed at a pace that would allow everyone to understand the basics thoroughly and make sure there was enough time allocated at the meetings to review our investments.

At this point we had determined to make our operating system more flexible, so Margot worked with our professional advisors to simplify the bylaws and overhaul the accounting. Though things were functioning more smoothly, the membership had grown to the point where there was simply more to do, from duplicating, collating, and mailing materials to keeping the networking strong.

COMING TOGETHER AS A GROUP

Keeping the group together that first year was even more difficult than staying on the Cabbage Diet. Reaching accord on every detail, with many different temperaments in the room, was a challenge. Women like Diane who are used to working as entrepreneurs had to adjust to making decisions by committee. The large brokerage firm with whom Marilyn is affiliated agreed to provide meeting space, but the meeting time was the subject of extensive debate. So was the format of the meeting. And of course we debated what type of investments to make and how long to stay with them. Some of our members were philosophically opposed to investing in certain types of businesses.

Some members were more knowledgeable about investing than others. The spectrum ranged from people like Joann Jordan and Harriette Rose Katz, who had dealt with brokers frequently, to Vivian Serota, who had never owned a stock or bond.

And there was some unhappiness with the 7:30 A.M. starting time, especially during the bitter cold, snowy, dreary winter. On the positive side, these minor inconveniences weeded out the women who weren't deeply committed to the club. Our original group of twenty-eight shrank to a hardy sixteen, all of whom earned one another's respect and deep friendship. Having a smaller group was an advantage while we were still getting organized, because it was easier to work with.

After discussions that rivaled anything at the United Nations, we decided in the second year to open the club to new members, including a few who had been "orphaned" by other clubs where the commitment wasn't strong enough to hold the members together. We now invite new members to a meeting each September to see how we operate and what their responsibilities will be. They are given workshops and clinics that bring them up to speed. At the moment, we are thirty-nine. Communicating with and overseeing details for a larger group is more time-consuming for the new officers and makes their burden somewhat greater, but at least the problems are fewer, since at this point we are running so smoothly. On the positive side, having a bigger group means we have more money to invest and thus to diversify.

ANTEING UP

We agreed to put in $1,100 per person at the start -- $1,000 for the investment and $100 as a one-time charge for legal fees and printing costs for drafting the partnership papers. Every month afterward, we'd each put in another $100 toward investing plus $15 for administrative and mailing costs such as accounting fees, photocopying, and mailing.

Unfortunately, many members failed to incorporate this item into their monthly check-writing routine. They would forget to bring the checks or come without their checkbooks, and our beleaguered treasurer, Carol, would have to hunt them down. We considered making a once-a-year payment instead. That would have put more money in the kitty and we would have had the money working for us all year. But the majority of people didn't want to write such a large check.

Philosophically, Marilyn was against the lump sum anyway. She wanted us to continue to invest a fixed amount regularly, no matter whether the market was up or down. This technique, called dollar cost averaging, has a couple of advantages. Making steady contributions kept our nest egg growing and helped us develop a habit of investing. We eventually decided to make quarterly payments -- $300 for investment and $45 for administrative costs.

We were realistic about our expectations. Putting aside $100 a month, particularly once you're over forty, as most of us were, cannot build a nest egg that will fund your retirement. Financial education was our number one goal, and we felt good about seeing our investments grow by percentages if not by dollars. Meanwhile, we were learning the language of investment and learning to think in a new way.

Before I joined the club, I thought you could look at stocks two ways. There was one kind of stock, speculative stock, that you could take a gamble on -- like high-tech stocks. Getting into them was like buying a vinyl slicker; it was showy, it was risky, but what the heck! The other kind were the blue chip stocks. Buying them was like buying a camel-hair topper. It might cost a little more, and it isn't so trendy, but it would hold up and be fine for a few years. When I joined the club, I realized the thinking was a lot more subtle than that. -- Carol Levin

LEARNING THE LANGUAGE

At the first meeting, Marilyn said something about reading a balance sheet, implying that we could. She was looking out the window, thank goodness, so she didn't see Diane and the woman next to her exchange a glance. Virtually every face in the room was wearing the same dubious expression. But no one said a word. Not a soul had enough self-confidence to put up her hand and say, "No, Marilyn, actually, I don't know how to read a balance sheet. Could you explain?" No one wanted to make a public confession of ignorance. Diane told Marilyn the next day, and Marilyn knew she'd have to stay with the basics, even with this sophisticated group.

At the beginning, everyone was literally hunched over with embarrassment, but as time passed we learned to relax and straighten up. It is important that other women know how much we didn't know, how much we managed to learn -- and how much fun we had doing it. -- Vivian Serota

Marilyn introduced us to the basics of investment. At the very first official meeting, she divided us into committees to study different sectors (like transportation or utilities) and prepare reports on specific companies, introduced us to research tools, and gave us guidelines for selecting stocks. Within a couple of meetings, we had already voted to make some purchases and our treasurer had placed the order with Marilyn.

Some clubs invest only in companies that are familiar, which more or less limits them to industrial companies. But it isn't smart to restrict your buying to one sector of the market, since different sectors do well in different economic circumstances. Marilyn encouraged us to think more broadly -- and stay flexible. A member assigned to study transportation stocks came in with a report about Nike. She figured that walking was a form of transportation, which led her to sneakers.

We quickly realized that sitting through an hour-and-a-half meeting once a month wouldn't teach us everything we needed to know. We had to do more reading and more learning. When necessary, Marilyn runs extra clinics. We may have to review some difficult subjects three and four times -- and sometimes even more -- before everyone gets to "Aha!"

We all started to follow the business and world news on TV and in the papers more closely.

Now I read the financial pages, and all the news pages, because what's happening around the world and the nation affects all the stocks. It used to take me twenty minutes to go through the newspaper. Now it takes me an hour. -- Margot Green

We also subscribed to various newsletters. Diane's favorite is Dick Davis's newsletter, which she says is the most readable and offers many points of view; Harriette likes John Dessauer's Investor's World for its upbeat approach. All this information is useful not only for making our reports but also for increasing our general awareness and knowledge.

PREPARING THE REPORTS

Since we buy stocks based on our reports, preparing them is a big responsibility. Each report gives as much information as possible on an individual company: the nature of its business, where it's located, who's on the management team, its past history, and of course, its future growth and earnings potential.

Though we had multiple stock committees at first, we found that researching the reports was very time-consuming. Now we have a single stock selection committee that consists of six to eight members who serve four-month rotations. Though the committee has the responsibility to find and research stocks, any member can bring the committee a suggestion at any time and/or attend its meeting, which many choose to do. (Sometimes they even bring guests.) It is a duty to serve -- but we like it. Preparing the reports is how we learn. And the committee members become so close that they are usually reluctant to give up their responsibility to the next team.

For the sake of diversity, Marilyn suggested that the club should own no fewer than twelve to fifteen different stocks -- but no more. Following more would be cumbersome.

We do our research in several ways, starting with sources like Standard & Poor's Stock Report and Value Line, which print complex, continually updated reports on every stock. All brokers have these publications, as do most libraries. We always call the company's investor relations department for an annual report, quarterlies, and any other information that is available. And those of us with private accounts call our brokers to ask for the analyst's report prepared at their firms. Many of our members are also going "on line" for financial and company information and sharing ideas with the rest of us.

Initially, the idea of writing and delivering a report threw some of us into a panic. Vivian Serota tried desperately to dodge the task. The material hadn't come in. She had laryngitis. She'd left the papers at home. She probably would have said the dog ate it, but she didn't have a dog. Though tempted to lend her a hand, Diane knew it was important for Vivian to do this herself. When she finally made her report, Vivian got a round of spontaneous applause. More important, the members voted to buy the stock on her recommendation. Many of us are still anxious about making a report, but none of us worries about feeling stupid anymore. The atmosphere is so supportive; and besides, at this point we have developed some expertise at going about the job.

I'm one of those people who feel, as that ad suggests, that you should "Squeeze the Charmin," which is exactly what I did when I researched the company that makes it. When I was working on Home Depot, I spent a day going down every aisle of the store. When I had to report on a hearing aid company, I went to its office and tried out all of the products. -- Jane Bishop Shalam

Now that we have grown confident enough to loosen up a bit, the reports have become more accurate, more interesting, and more entertaining. Harriette Rose Katz, who organizes events, reported on a company that owns funeral homes and provides accessory services from flowers to limousines. She suggested that we think of the company as the party planner of the funeral business. That was perfectly clear to everyone, and we bought the stock. Making her presentation about Tiffany's, Gloria Gottlieb arrived with a "show and tell" -- the familiar robin's egg blue box from the world-famous retailer. (She never mentioned whether she had been obliged to buy something new in order to get the box.)

One group became so enthusiastic about the research process that they call themselves the Tipsters and hold their own monthly meeting in addition to club gatherings.

It's a thrill when the group votes to buy a stock on your recommendation. When we invest, we usually buy an amount that's close to a whole number. It used to be about $5,000, but now that the club is larger, we are buying in larger amounts.

In contrast, it's a bit wrenching when the club decides to sell the stock you've "sponsored." Marilyn distributes monthly updates on each stock that include its purchase price, the length of time we have held it, our gains or losses, and the percentage of the portfolio the stock holding represents. Members assigned to follow these stocks (another rotating task) may report on new developments. Then we discuss whether to buy, sell, or hold the stock.

Within a year, the group was very much in charge of its own meeting. Marilyn had become more of a counselor than a teacher. She continues to discuss trends and interpret the movements of the market, helps take the emotion out of our discussions,and may be asked to make the swing vote if there's a stalemate. We have the experience and information-gathering skills to feel comfortable about making investment decisions not only for the group but for our personal portfolios.

WHEN THE MEMBERSHIP CHANGES

We have a three-strikes rule: If you miss more than three meetings, you're out. One member had to reschedule a flight to Europe to be in compliance. We weren't happy to inconvenience her, but our rules stand.

We haven't asked anyone to leave, but some of the original members decided the time commitment was more than they were prepared to make and bowed out. Whether the departure is by request or voluntary, the procedure is the same. We buy the member out. To keep the departure process orderly, we allow only periodic resignations. You must wait until our quarterly collecting and accounting to get a disbursement. This keeps our cash reserve from dipping too low.

Thanks to monthly contributions and the fact that our investments had done well, the original investment of $1,000 by each charter member had tripled by the time we invited our first new members, so they each paid about $3,000. New members continue to buy in at whatever a share is currently worth: our total assets divided by the number of members.

WHAT THE CLUB HAS MEANT TO US

By the end of the second year, we'd worked out most of the kinks and things were moving very smoothly. Our once-chaotic meetings have become symphonic, because the Executive Committee spends a lot of time preparing so that the meeting runs as smoothly as possible. There's so much to cover in an hour and a half that we schedule educational programs for alternate meetings only. And we schedule clinics and review sessions with Marilyn in the evenings, largely for new members but also for old ones. There's always something new to learn.

Choosing and watching your investments is a place to start learning about money. But the real value of the club is that it has made us think in a very different way.

This club empowered me to make decisions about many things. I've begun spending less on clothes and accessories. Today I'd rather buy stock. I'm in a service business that has a limited return on investment. The only way I can accumulate money is through my investment portfolio. -- Harriette Rose Katz

We were also exposed to a great deal of new knowledge by a myriad of experts. Our club lawyer, Charles Hecht, gave us the story on insider trading. Peter Schaeffer invited club members to his world-renowned Fifth Avenue gallery, A la Vielle Russie, where he talked about collecting art as an investment. Experts from mutual fund companies, including AIM, Alliance, Oppenheimer, and Seligman Henderson, money managers from Lazard Frères and Provident Capital, leading technical analyst JeffWeiss, and renowned Wall Street expert Mary Farrell also responded to Marilyn's request to share their knowledge. So did disability and life insurance analysts. Value Line's Richard Sandborne explained how to use this reference tool. After attorney Steven Shanker and insurance specialist Gary Bleetstein led a session on estate planning, club member Carlyn McCaffrey organized a three-part evening program, "What You Need to Know About Your Husband's Estate," drew a crowd that included several of our spouses. Not long ago accountant Anthony Graci came in to explain tax strategies and -- at last -- how to read a balance sheet!

No matter what age you are or where you are located, there is a great deal of knowledge available to you. If you form a club, you can call on lawyers and brokers and insurance experts and accountants. Perhaps you'd want to schedule a session on financing college tuition or retirement planning. You'll open yourself up to new knowledge and new power. We certainly did. When we look back on that first day, we realize how much we've learned and shared. We're now part of a team, equal players on a level playing field. When we don't know something, we're comfortable about asking. More important, we now see the connections among every aspect of our personal finances. Our investments are part of our overall financial planning, which in turn is related to asset allocation, which involves retirement planning, life insurance, and estate planning. And that's what we cover in this book.

We won't promise that all the material will be easy. We do promise that all of it is important. The book will speak to you in the many voices of the women who shared their stories, on and off the record. Some of the women are club members. Others are women who heard about our book and volunteered to be a part of it, motivated by a desire to have other women learn from their mistakes. Once you've learned the lessons they have to teach, you won't feel dumb or frightened again. You'll be in charge of your personal finances and able to help make your future secure.

After the club was formed, a small group of us spoke at an adult education program at the Learning Annex. We wanted to share our experiences and assure other women that they can take control of their financial lives. We hoped our listeners would think, "These women are intelligent, capable people -- and yet not too long ago, they were insecure about their finances. If they needed help, then I guess it's not so strange that I do, too." We were amazed that our audience included women from so many different backgrounds, from a CEO to an astrologer. It was an enormous thrill to have them look to us for inspiration. Even better was to run into one or two of them long afterward and have them come up to us and say, "You've changed my life."

Now we hope to change yours.

Copyright © 1997 by Marilyn Hope Crockett, Diane Terman Felenstein, and Dale Burg

GETTING IT TOGETHER

Founding The Club

My husband confessed that he was having huge financial problems and hadn't been paying the mortgage. We were in danger of losing our home. We needed new advisors to replace the lawyer and accountant who'd let us slide into a financial chasm, and I wasn't sure how to use my own money to protect the two of us. Thank God I'd joined the club. I had networks to reach out to, people to consult. Best of all, when we got advice, I understood the issues. I had a confidence I'd never had before, and to my lasting pride, I'm the one who got us out of trouble. Every woman should have a club like this one. -- Anonymous

From 1985 to 1995, the all-female investment clubs in America -- about 41 percent of the total number of clubs -- outperformed the all-male clubs (13 percent) by three to one. Today's women aren't meeting to make quilts. They're weaving financial safety nets.

There are many investment clubs in America, but ours is unique. Thought at the beginning we spent most of our time on investments,that was simply to lay the foundation. We intended to branch out and educate ourselves about money and everything else that affected our financial lives. And that's just what we have done.

When the women who would become The Money Club gathered in a Manhattan apartment for the very first time, there were eighteen people in the room -- married and single, widowed and divorced. Most were linked only through their friendship with Diane. On the jacket of the book are some of the charter members and others who became important to our success. They are:

Top row, left to right:

Vivian Serota, a glamorous, earthy, effervescent patron of the arts, has a diverse management and theatrical production background. She serves on the board of Daytop Village International addiction treatment centers and the Guggenheim's "Learning to Read Through the Arts." She is married and the mother of a married son and married daughter.

Carol Levin, a women's activist, brings the pixie charm of Liza Minnelli, an offhand humor, and tremendous vitality to her beloved Women's O.W.N. (Optimum Wellness Now) and many other projects. She and her husband, the CEO of Revlon, have one daughter in high school and a married son and daughter-in-law who have followed them from Minneapolis to New York.

Carol Safir, like her husband, Howard, the New York City Police Commissioner, former Fire Commissioner, and onetime Associate Director of the U.S. Marshal Service, has worn many hats, among them real estate agent and international business consultant. An auburn-haired "girl next door," she has a son fresh out of law school and a daughter who is a newly minted FBI agent.

Carlyn McCaffrey has a wry wit and sharp mind that have earned her an exalted reputation among trusts and estates attorneys while her genuine concern has earned her the gratitude of her clients. A partner in the New York law firm of Weil, Gotshal & Manges, she has a bicontinental relationship with her husband, who presently works in Europe. They have four adult children.

Second row, left to right:

Diane Steiner, with a dazzling smile and great determination, blends empathy and intelligence with a passionate commitment to her clients' rights that make her a top matrimonial lawyer in one of New York's premier firms, Sheresky, Aronson & Mayefsky. She is married and the mother of a grown son and daughter.

Kate Coburn, lively and curly-haired, packs a lot of energy and drive into a size-four body. Well known in New York real estate circles as the head of retail leasing for Rockefeller Center, she now advises other owners, developers, and retailers on strategic marketing and leasing issues.

Diane Terman Felenstein.

Gloria Gottlieb, a willowy blonde with a mischievous grin, started an insurance business with her husband just after their marriage. They are now among New York's top agents. Their park-view home is filled with modern art and photos of their grown son and daughter.

Bottom row, left to right:

Margot Green, dark-haired, trim, and elegant, turned her sophisticated taste into a business asset and founded a custom couture establishment. Known to her clientele as "the fastidious fitter," she is the mother of two adult sons.

Harriette Rose Katz, a statuesque blonde and leading New York event planner of private and public celebrations, is also a culinary expert and oenophile who has been awarded the title Conseiller Gastronomique des Etats-Unis and heads the New York chapter of La Chaîine des Rôtisseurs. She recently planned the wedding of her daughter.

Marilyn Crockett.

Jane Bishop Shalam, a delicate beauty, marshals her abundant charm and formidable organizing skills to get extraordinary results as a community activist and as a dedicated club member. Married and the mother of three sons, she's also helping raise her widowed brother's preteen daughter.

Carol S. Kogan combines the cool elegance of a fashion model with the mind of a crackerjack executive. Formerly president of several top women's designer apparel companies including Bill Blass and Oscar de la Renta Studio for Hero and Christian Dior Sportswear for the Jones Apparel Group, she has a business network throughout the United States, Europe, and the Far East. She divides her energies among her own consulting company, her husband's international movie business, her son, daughter, and new granddaughter.

Other founding members of the club, not pictured, include:

Donna Bijur and Linda Lieberman, directors of Service Party Rental. Donna is now a consultant in Sweden, and Linda has also launched another business, "Just Linens."

Bambi Felberbaum, a board member of several hospitals, is a supporter of philanthropic programs that focus on women's, children's, and medical issues. She is married with two adult children.

Karen Fisher is the president of Designer Previews, a designer referral service.

Joann Jordan, a real estate broker for fifteen years, is currently with Ashforth Warburg Associates. Joann, who became the second president of the club, is a widow with an adult son and daughter.

Pat Weinbach, a designer, heads her own firm specializing in remodeling and renovations. She is married, with three adult children.

We had a lot of experience under our collective belt. Among us, we had traveled the world, met with statesmen and popes, been invited to the White House and the Academy Awards, run volunteer organizations with million-dollar budgets, and demonstrated our competence in executive offices and professional suites.

But those of us who were married didn't discuss money issues with our husbands, to whom we'd left all the financial control. If single, we stumbled along as best we could. Very little stumped us in other areas, but we knew nothing about dealing with our money. We didn't know how to calculate what we had, what to do about it, how to protect it, even how to find and talk to people who could help us. The very subject of personal finance frightened us.

Our group included women with power and access in their own right and/or married to highly placed professionals, some of whom were top executives at leading investment banking and accounting firms. Being generally well connected, we had access to information that others might not. But having money and access isn't the same as feeling in control of the money or knowing how to use the access. As a group, we were as financially unsophisticated as could be.

Even the wives of top-echelon money men didn't know any more about finance than anyone else. Money, investing, personal finance -- these subjects are on the dark side of the moon for many women, including all of us. And though on the surface every woman in our group was traveling in privileged circles, we eventually realized that almost all had faced a personal crisis around an issue of money. Our families had struggled, we'd seen fathers and husbands fail, we'd been obliged to support ourselves on our own and been left in a financial lurch when widowed or divorced.

One of our members was just in her twenties when her husband died of heart failure, leaving her with a baby; remarrying a few years later, she was widowed a second time. After her divorce, another member went to withdraw savings from the bank and discovered her husband had drained the account. As a young wife, another had helped her husband write checks for bills each week and later found that he'd put the carefully stamped envelopes into the incinerator instead of the mail slot. Another came home one Sunday to discover her husband gone and the house picked clean. Every piece of furniture and shred of clothing had been stored or sold. She never saw any of it again.

Even after joining our club, some members had to come to grips with devastating changes. Two lost high-powered jobs and all the financial benefits that come with them. When we considered doubling the amount of our monthly contributions, they told us that if the obligation went up, they'd have to drop out, so we kept the status quo. When someone's husband had a business failure that forced him into bankruptcy, we joined forces to help her out during that difficult period. Our second president, Joann Jordan, lost her husband suddenly and without warning. Becoming immersed in club activities was one means of coping. "It was a diversion from my grief and a form of self-protection, because it helped me learn how to maximize my finances." Being in the club has made a big difference to every single one of us, each in her own way.

We are a no-frills operation. There is no coffee served and little socializing. We get right to business and rush off to our offices and duties immediately afterward. Still, because we are dealing with a subject that affected the underpinnings of our lives, we have bonded more closely than any group we'd ever been part of.

At the beginning, we used the words "frightened" and "stupid" to describe how we felt, and we discovered we had plenty of company. We learned not to allow anyone to "pull the ignorant strings," as one woman described it. Everyone was encouraged, given the freedom to ask questions and make mistakes, to receive sympathy and face challenges. That nurturing environment was a huge help.

Learning together makes you feel safe -- like Weight Watchers or Overeaters Anonymous. -- Carol Levin

In learning how to care for ourselves, we became competent to help each other. In times of need, we can now help choose attorneys and accountants and insurance brokers. We have suggestions of substance. We have grown in competence and confidence and developed the tools and resources to empower ourselves.

From our positive experience came the desire to let other women know that though we might live in the middle of New York City, we are in many ways like women all across America. We have experienced the same fears and feelings of powerlessness, and we know that they can learn to take control just as we did. Starting your own club may be the first step in the process.

Fortunately, our club had just the right people to help us find our way. Diane is the leader-cheerleader who motivates the members with her enthusiasm and keeps our bonds strong. If necessary she soothes ruffled feathers and sifts through complaints to see which have merit and must be addressed. She has an unflagging belief in the importance of the club, and her absolute faith has held it together.

Marilyn has kept the members on educational course, guiding us through the fundamentals of personal finance and eventually acting as a sounding board. She helps interpret the reports on potential investments and connects them to what's happening in the market. She has found a wide range of guest speakers.

The National Association of Investors Corporation (NAIC) is immensely helpful in setting up a club, though we augmented their suggestions with a do-it-yourself approach. Fortunately, we had wonderful assistance from our attorney, Charles J. Hecht; our accountants, Carolyn Specht, CPA, of Pierpoint Associates and Anthony Graci of Grodsky, Caporrino, & Kaufman; and our banker, Philip Glazer at Republic National Bank.

We concluded that the best structure for our particular club would be an LLC -- a limited liability company, which combines the tax benefits of a partnership with the limited risk of a corporation. The latter was especially important to those of our members who had significant assets in their own names.

Charles drew up the papers and helped us adopt an initial set of bylaws to govern the day-to-day working of the club. A bigger challenge was in selecting officers. None of us had any experience with an organization of this kind, yet we knew that the first group of leaders would be establishing precedents. Certainly successive officers would modify them, but the first officers would be blazing the trail.

HOW THE MEMBERS RUN THE CLUB

Diane was elected our first president, largely on the theory that she was the driving force behind the club and couldn't quit even if she wanted to!

Kate Coburn was elected vice president, because of her extensive business experience.

Carol S. Kogan served as our first treasurer, primarily because she had had a great deal of bottom-line responsibility in her career. In addition to keeping the club's books, Carol checked over the brokerage house statements and other financial accounts and worked with the accountant. Though the job was extremely time-consuming, she probably learned more than anyone else in the club.

Donna Bijur and Linda Lieberman, who already worked together running one of the city's largest party rental firms, agreed to keep working together as co-secretaries. Taking the lengthy minutes that documented all our decisions proved to be a major job.

These officers and Marilyn constituted our first Executive Committee, charged with developing proposals and policies that could be considered by the membership.

The first set of officers worked much harder than they had expected to. At the end of a year, they handed the torch over to their successors: Joann Jordan became president, Jane Shalam became vice president, and Margot Green became treasurer. Joann personally called many members to ask their guidance in strengthening and improving the club. The members were unanimous in their praise of the guest speakers. They wanted even more of them, covering even more subjects; they wanted to proceed faster and learn about more sophisticated concepts, like convertible bonds and selling short. But Joann and Marilyn agreed not to rush ahead, to proceed at a pace that would allow everyone to understand the basics thoroughly and make sure there was enough time allocated at the meetings to review our investments.

At this point we had determined to make our operating system more flexible, so Margot worked with our professional advisors to simplify the bylaws and overhaul the accounting. Though things were functioning more smoothly, the membership had grown to the point where there was simply more to do, from duplicating, collating, and mailing materials to keeping the networking strong.

COMING TOGETHER AS A GROUP

Keeping the group together that first year was even more difficult than staying on the Cabbage Diet. Reaching accord on every detail, with many different temperaments in the room, was a challenge. Women like Diane who are used to working as entrepreneurs had to adjust to making decisions by committee. The large brokerage firm with whom Marilyn is affiliated agreed to provide meeting space, but the meeting time was the subject of extensive debate. So was the format of the meeting. And of course we debated what type of investments to make and how long to stay with them. Some of our members were philosophically opposed to investing in certain types of businesses.

Some members were more knowledgeable about investing than others. The spectrum ranged from people like Joann Jordan and Harriette Rose Katz, who had dealt with brokers frequently, to Vivian Serota, who had never owned a stock or bond.

And there was some unhappiness with the 7:30 A.M. starting time, especially during the bitter cold, snowy, dreary winter. On the positive side, these minor inconveniences weeded out the women who weren't deeply committed to the club. Our original group of twenty-eight shrank to a hardy sixteen, all of whom earned one another's respect and deep friendship. Having a smaller group was an advantage while we were still getting organized, because it was easier to work with.

After discussions that rivaled anything at the United Nations, we decided in the second year to open the club to new members, including a few who had been "orphaned" by other clubs where the commitment wasn't strong enough to hold the members together. We now invite new members to a meeting each September to see how we operate and what their responsibilities will be. They are given workshops and clinics that bring them up to speed. At the moment, we are thirty-nine. Communicating with and overseeing details for a larger group is more time-consuming for the new officers and makes their burden somewhat greater, but at least the problems are fewer, since at this point we are running so smoothly. On the positive side, having a bigger group means we have more money to invest and thus to diversify.

ANTEING UP

We agreed to put in $1,100 per person at the start -- $1,000 for the investment and $100 as a one-time charge for legal fees and printing costs for drafting the partnership papers. Every month afterward, we'd each put in another $100 toward investing plus $15 for administrative and mailing costs such as accounting fees, photocopying, and mailing.

Unfortunately, many members failed to incorporate this item into their monthly check-writing routine. They would forget to bring the checks or come without their checkbooks, and our beleaguered treasurer, Carol, would have to hunt them down. We considered making a once-a-year payment instead. That would have put more money in the kitty and we would have had the money working for us all year. But the majority of people didn't want to write such a large check.

Philosophically, Marilyn was against the lump sum anyway. She wanted us to continue to invest a fixed amount regularly, no matter whether the market was up or down. This technique, called dollar cost averaging, has a couple of advantages. Making steady contributions kept our nest egg growing and helped us develop a habit of investing. We eventually decided to make quarterly payments -- $300 for investment and $45 for administrative costs.

We were realistic about our expectations. Putting aside $100 a month, particularly once you're over forty, as most of us were, cannot build a nest egg that will fund your retirement. Financial education was our number one goal, and we felt good about seeing our investments grow by percentages if not by dollars. Meanwhile, we were learning the language of investment and learning to think in a new way.

Before I joined the club, I thought you could look at stocks two ways. There was one kind of stock, speculative stock, that you could take a gamble on -- like high-tech stocks. Getting into them was like buying a vinyl slicker; it was showy, it was risky, but what the heck! The other kind were the blue chip stocks. Buying them was like buying a camel-hair topper. It might cost a little more, and it isn't so trendy, but it would hold up and be fine for a few years. When I joined the club, I realized the thinking was a lot more subtle than that. -- Carol Levin

LEARNING THE LANGUAGE

At the first meeting, Marilyn said something about reading a balance sheet, implying that we could. She was looking out the window, thank goodness, so she didn't see Diane and the woman next to her exchange a glance. Virtually every face in the room was wearing the same dubious expression. But no one said a word. Not a soul had enough self-confidence to put up her hand and say, "No, Marilyn, actually, I don't know how to read a balance sheet. Could you explain?" No one wanted to make a public confession of ignorance. Diane told Marilyn the next day, and Marilyn knew she'd have to stay with the basics, even with this sophisticated group.

At the beginning, everyone was literally hunched over with embarrassment, but as time passed we learned to relax and straighten up. It is important that other women know how much we didn't know, how much we managed to learn -- and how much fun we had doing it. -- Vivian Serota

Marilyn introduced us to the basics of investment. At the very first official meeting, she divided us into committees to study different sectors (like transportation or utilities) and prepare reports on specific companies, introduced us to research tools, and gave us guidelines for selecting stocks. Within a couple of meetings, we had already voted to make some purchases and our treasurer had placed the order with Marilyn.

Some clubs invest only in companies that are familiar, which more or less limits them to industrial companies. But it isn't smart to restrict your buying to one sector of the market, since different sectors do well in different economic circumstances. Marilyn encouraged us to think more broadly -- and stay flexible. A member assigned to study transportation stocks came in with a report about Nike. She figured that walking was a form of transportation, which led her to sneakers.

We quickly realized that sitting through an hour-and-a-half meeting once a month wouldn't teach us everything we needed to know. We had to do more reading and more learning. When necessary, Marilyn runs extra clinics. We may have to review some difficult subjects three and four times -- and sometimes even more -- before everyone gets to "Aha!"

We all started to follow the business and world news on TV and in the papers more closely.

Now I read the financial pages, and all the news pages, because what's happening around the world and the nation affects all the stocks. It used to take me twenty minutes to go through the newspaper. Now it takes me an hour. -- Margot Green

We also subscribed to various newsletters. Diane's favorite is Dick Davis's newsletter, which she says is the most readable and offers many points of view; Harriette likes John Dessauer's Investor's World for its upbeat approach. All this information is useful not only for making our reports but also for increasing our general awareness and knowledge.

PREPARING THE REPORTS

Since we buy stocks based on our reports, preparing them is a big responsibility. Each report gives as much information as possible on an individual company: the nature of its business, where it's located, who's on the management team, its past history, and of course, its future growth and earnings potential.

Though we had multiple stock committees at first, we found that researching the reports was very time-consuming. Now we have a single stock selection committee that consists of six to eight members who serve four-month rotations. Though the committee has the responsibility to find and research stocks, any member can bring the committee a suggestion at any time and/or attend its meeting, which many choose to do. (Sometimes they even bring guests.) It is a duty to serve -- but we like it. Preparing the reports is how we learn. And the committee members become so close that they are usually reluctant to give up their responsibility to the next team.

For the sake of diversity, Marilyn suggested that the club should own no fewer than twelve to fifteen different stocks -- but no more. Following more would be cumbersome.

We do our research in several ways, starting with sources like Standard & Poor's Stock Report and Value Line, which print complex, continually updated reports on every stock. All brokers have these publications, as do most libraries. We always call the company's investor relations department for an annual report, quarterlies, and any other information that is available. And those of us with private accounts call our brokers to ask for the analyst's report prepared at their firms. Many of our members are also going "on line" for financial and company information and sharing ideas with the rest of us.

Initially, the idea of writing and delivering a report threw some of us into a panic. Vivian Serota tried desperately to dodge the task. The material hadn't come in. She had laryngitis. She'd left the papers at home. She probably would have said the dog ate it, but she didn't have a dog. Though tempted to lend her a hand, Diane knew it was important for Vivian to do this herself. When she finally made her report, Vivian got a round of spontaneous applause. More important, the members voted to buy the stock on her recommendation. Many of us are still anxious about making a report, but none of us worries about feeling stupid anymore. The atmosphere is so supportive; and besides, at this point we have developed some expertise at going about the job.

I'm one of those people who feel, as that ad suggests, that you should "Squeeze the Charmin," which is exactly what I did when I researched the company that makes it. When I was working on Home Depot, I spent a day going down every aisle of the store. When I had to report on a hearing aid company, I went to its office and tried out all of the products. -- Jane Bishop Shalam

Now that we have grown confident enough to loosen up a bit, the reports have become more accurate, more interesting, and more entertaining. Harriette Rose Katz, who organizes events, reported on a company that owns funeral homes and provides accessory services from flowers to limousines. She suggested that we think of the company as the party planner of the funeral business. That was perfectly clear to everyone, and we bought the stock. Making her presentation about Tiffany's, Gloria Gottlieb arrived with a "show and tell" -- the familiar robin's egg blue box from the world-famous retailer. (She never mentioned whether she had been obliged to buy something new in order to get the box.)

One group became so enthusiastic about the research process that they call themselves the Tipsters and hold their own monthly meeting in addition to club gatherings.

It's a thrill when the group votes to buy a stock on your recommendation. When we invest, we usually buy an amount that's close to a whole number. It used to be about $5,000, but now that the club is larger, we are buying in larger amounts.

In contrast, it's a bit wrenching when the club decides to sell the stock you've "sponsored." Marilyn distributes monthly updates on each stock that include its purchase price, the length of time we have held it, our gains or losses, and the percentage of the portfolio the stock holding represents. Members assigned to follow these stocks (another rotating task) may report on new developments. Then we discuss whether to buy, sell, or hold the stock.

Within a year, the group was very much in charge of its own meeting. Marilyn had become more of a counselor than a teacher. She continues to discuss trends and interpret the movements of the market, helps take the emotion out of our discussions,and may be asked to make the swing vote if there's a stalemate. We have the experience and information-gathering skills to feel comfortable about making investment decisions not only for the group but for our personal portfolios.

WHEN THE MEMBERSHIP CHANGES

We have a three-strikes rule: If you miss more than three meetings, you're out. One member had to reschedule a flight to Europe to be in compliance. We weren't happy to inconvenience her, but our rules stand.

We haven't asked anyone to leave, but some of the original members decided the time commitment was more than they were prepared to make and bowed out. Whether the departure is by request or voluntary, the procedure is the same. We buy the member out. To keep the departure process orderly, we allow only periodic resignations. You must wait until our quarterly collecting and accounting to get a disbursement. This keeps our cash reserve from dipping too low.

Thanks to monthly contributions and the fact that our investments had done well, the original investment of $1,000 by each charter member had tripled by the time we invited our first new members, so they each paid about $3,000. New members continue to buy in at whatever a share is currently worth: our total assets divided by the number of members.

WHAT THE CLUB HAS MEANT TO US

By the end of the second year, we'd worked out most of the kinks and things were moving very smoothly. Our once-chaotic meetings have become symphonic, because the Executive Committee spends a lot of time preparing so that the meeting runs as smoothly as possible. There's so much to cover in an hour and a half that we schedule educational programs for alternate meetings only. And we schedule clinics and review sessions with Marilyn in the evenings, largely for new members but also for old ones. There's always something new to learn.

Choosing and watching your investments is a place to start learning about money. But the real value of the club is that it has made us think in a very different way.

This club empowered me to make decisions about many things. I've begun spending less on clothes and accessories. Today I'd rather buy stock. I'm in a service business that has a limited return on investment. The only way I can accumulate money is through my investment portfolio. -- Harriette Rose Katz

We were also exposed to a great deal of new knowledge by a myriad of experts. Our club lawyer, Charles Hecht, gave us the story on insider trading. Peter Schaeffer invited club members to his world-renowned Fifth Avenue gallery, A la Vielle Russie, where he talked about collecting art as an investment. Experts from mutual fund companies, including AIM, Alliance, Oppenheimer, and Seligman Henderson, money managers from Lazard Frères and Provident Capital, leading technical analyst JeffWeiss, and renowned Wall Street expert Mary Farrell also responded to Marilyn's request to share their knowledge. So did disability and life insurance analysts. Value Line's Richard Sandborne explained how to use this reference tool. After attorney Steven Shanker and insurance specialist Gary Bleetstein led a session on estate planning, club member Carlyn McCaffrey organized a three-part evening program, "What You Need to Know About Your Husband's Estate," drew a crowd that included several of our spouses. Not long ago accountant Anthony Graci came in to explain tax strategies and -- at last -- how to read a balance sheet!

No matter what age you are or where you are located, there is a great deal of knowledge available to you. If you form a club, you can call on lawyers and brokers and insurance experts and accountants. Perhaps you'd want to schedule a session on financing college tuition or retirement planning. You'll open yourself up to new knowledge and new power. We certainly did. When we look back on that first day, we realize how much we've learned and shared. We're now part of a team, equal players on a level playing field. When we don't know something, we're comfortable about asking. More important, we now see the connections among every aspect of our personal finances. Our investments are part of our overall financial planning, which in turn is related to asset allocation, which involves retirement planning, life insurance, and estate planning. And that's what we cover in this book.

We won't promise that all the material will be easy. We do promise that all of it is important. The book will speak to you in the many voices of the women who shared their stories, on and off the record. Some of the women are club members. Others are women who heard about our book and volunteered to be a part of it, motivated by a desire to have other women learn from their mistakes. Once you've learned the lessons they have to teach, you won't feel dumb or frightened again. You'll be in charge of your personal finances and able to help make your future secure.

After the club was formed, a small group of us spoke at an adult education program at the Learning Annex. We wanted to share our experiences and assure other women that they can take control of their financial lives. We hoped our listeners would think, "These women are intelligent, capable people -- and yet not too long ago, they were insecure about their finances. If they needed help, then I guess it's not so strange that I do, too." We were amazed that our audience included women from so many different backgrounds, from a CEO to an astrologer. It was an enormous thrill to have them look to us for inspiration. Even better was to run into one or two of them long afterward and have them come up to us and say, "You've changed my life."

Now we hope to change yours.

Copyright © 1997 by Marilyn Hope Crockett, Diane Terman Felenstein, and Dale Burg

Product Details

- Publisher: Touchstone (September 17, 1998)

- Length: 320 pages

- ISBN13: 9780684846057

Browse Related Books

Raves and Reviews

Publishers Weekly The book covers seemingly everything one needs to know to become secure financially.

Meredith Kahn Harper's Bazaar Straightforward chapters give you all the info you need to keep your cash flow heading in the right direction.

Resources and Downloads

High Resolution Images

- Book Cover Image (jpg): The Money Club Trade Paperback 9780684846057